Law of Equi-Marginal Utility

This law of consumption was propounded by a French economist, H. H. Gossen in 1854, and it is also known as the Second Law of Gossen. We are aware that every man has unending wants. Wants keep coming up, but a man only has so much money to spend on satisfying them, and money can also be used for other things. Man must therefore constantly find ways to divide limited resources among different uses in order to satisfy all of his wants (or utility). The answer to this issue is provided by the Law of Equi-Marginal Utility. According to this law, a person should spend their money on various things so that the utility of the last unit of money spent on each item is equal to or nearly equal to what they want to get the most satisfaction out of it.

(OR)

The relationship between the consumption of two or more products and the combinations of consumption that will result in the most satisfaction is explained by the Law of Equi-Marginal Utility. The additional satisfaction obtained from consuming one more unit of a commodity is known as marginal utility.

(OR)

According to the law of equi-marginal utility, a consumer must distribute his income among the products so that the utility derived from the final rupee spent on each product is equal. In other words, when the marginal utility of money spent on each product is the same, the consumer is in an equilibrium position.

The question now is how he would distribute his income among different goods, or what would be his equilibrium position with regard to the buying of different goods. It should be noted that the consumer is considered to be “intelligent,” which means that he substitutes goods for one another carefully and coldly in order to maximise his utility or satisfaction.

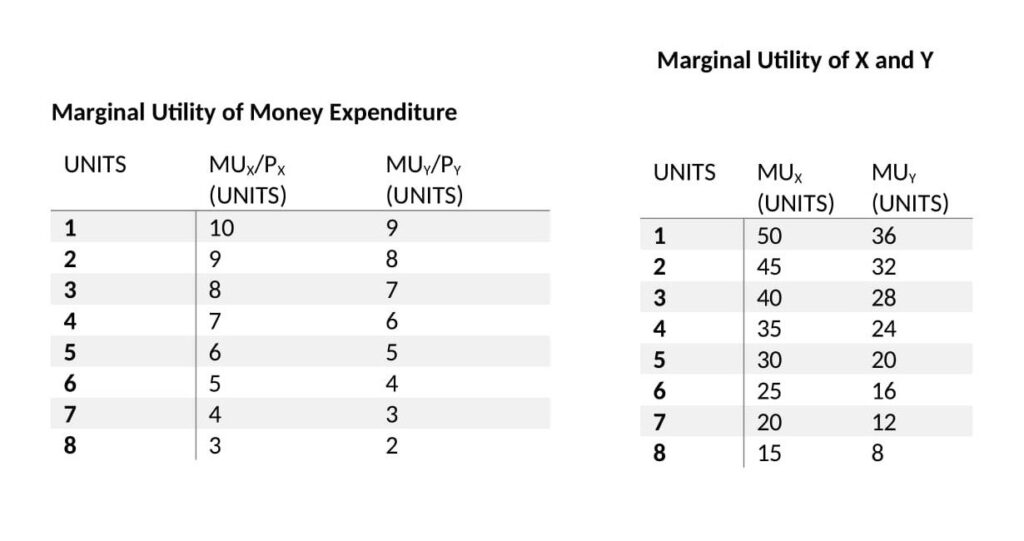

Let’s say a consumer only has to spend a certain amount of money on the two goods X and Y. The marginal utility of the goods and the prices of the two goods will both influence the consumer’s behaviour. Assume that the consumer is provided with the product prices.

The marginal utility of money spent on a product is now equal to that good’s marginal utility divided by its price.

Symbolically,

MUe= MUZ/PZ

Where Pz is the price of X, MUz is the marginal utility of the goods X, and MUe is the marginal utility of money expenditure. Thus, the law of equi-marginal utility can be stated as follows: the consumer will spend his income on various products in a manner that guarantees the marginal utility of each good is inversely proportional to its cost. In other words, a consumer is in equilibrium with regard to the buying of two goods, X and Y, when

MUz/ PZ = MUz / PZ

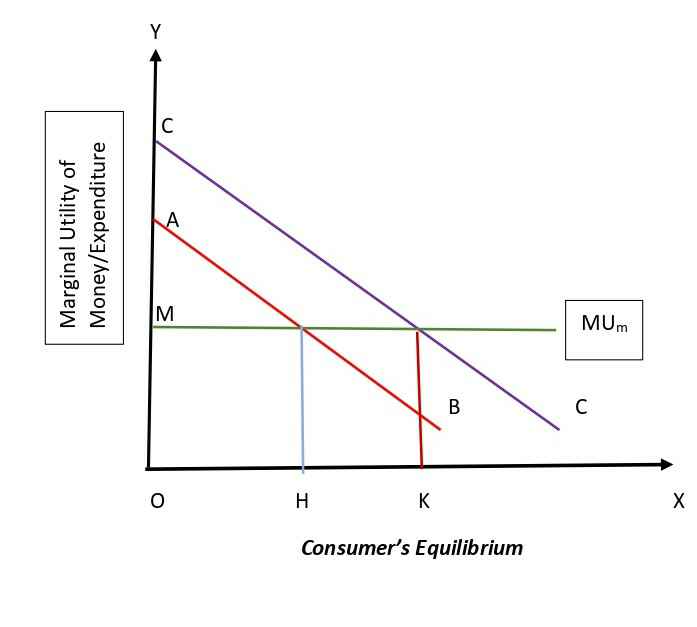

A consumer will substitute products X for products Y if MUz / PZ and MUy / PZ are not equal and MUz / PZ is greater than MUz / PZ. The marginal utility of the products Y will increase as a result of this substitution. The consumer will keep switching between products X and products Y until MUy/PZ equals MUy/PZ. The consumer will be in equilibrium when MUZ/ PZ equals MUY/ PZy. However, it is possible to accomplish the equality of MUZ/PZ and MUy/PZ at different levels of spending as well as at a single level. How far a consumer goes in acquiring the products he wants is the question. The amount of money he spends determines this. A rupee has a specific utility for him with a given expenditure; this utility is his marginal utility of money.

Since the law of diminishing marginal utility also applies to money, the consumer will continue to buy products as long as his money expenditure increases until the marginal utility of each good’s expenditure equals the marginal utility of money to him.

Therefore, when the following equation holds true, the consumer will be in equilibrium:

MUZ,/PZ = MUY/Py = MUm

This equilibrium condition can be extended to an ‘n’ number of commodities.For ‘n’ number of commodities, the equilibrium condition is:

MUA/PA= MUB/PB= MUC/PC = ……… = MUn/Pn

The aforementioned equation must be true for all of the commodities that the consumer spends his income on if there are more than two.

Assumptions of the Law of Equi Marginal Utility:

1) No change in price.

The prices of the product has not changed.If the price changes then law is not applicable.

2) Fixed income

The consumer’s income is set.In order to have this law, it is necessary the consumer has fixed amount of income.

3) Constant MU:

The marginal utility of money is constant.

4 ) Awareness of consumer:

The consumer is fully aware of the utility of the products.

5) Rational Consumer:

The consumer, being a normal person, tries to find the most satisfaction possible.

6) Use of cardinal terms:

Cardinal terms can be used to measure the utility.

7) Unlimited wants:

Consumers have a lot of wants.

8) Product Substitute:

The products have substitutes.

CRITICISMS, LIMITATIONS OR EXCEPTIONS OF LAW OF EQUI-MARGINAL UTILITY

The following are the main arguments H. H. Gossen used to criticise the Law of Equi-Marginal Utility. Although it is a fundamental economic law, consumers are still required to abide by it, whether consciously or unconsciously. Every area of economic analysis is covered by this law.

1) Generally Consumers are not Calculative by Nature

Instead of spending their money based on calculations, consumers spend it in accordance with their habits.

2) Goods’ Indivisibility:

Some goods, like rickshaws, cameras, computers, etc., cannot be broken down into smaller units. As a result, it is impossible to compare the utility of these units, nor can they be compared to the marginal unit of other commodities.

3) Customers Lack Rationality:

In general, customs, traditions, habits, and fashion have an impact on man. Therefore, he unintentionally spends his money on goods with lower utility. Consequently, he is not always logical.

4) It Is Not Possible to Measure Utility Accurately:

Because utility is a mental satisfaction, it cannot be accurately measured.

5. Money’s Utility is Not Stable:

Similar to the utility of commodities, the utility of money is continuously declining. Moreover, while money was assumed to be stable in this law, the prices of commodities are constantly fluctuating (increasing and decreasing).

6) Lack of Utility Knowledge:

In general, consumers are ignorant of the benefits of the goods they purchase.

7) Durability of Goods:

Long-term utility is something that durable goods provide for us. Therefore, it is difficult to evaluate the marginal utility of these products in the short term.

8) Maximum Utility Does Not mean Maximum Satisfaction:

According to critics, this law allows for the maximisation of actual utility but not total satisfaction. However, in real life, utility and satisfaction are two different things that are not directly related to one another.

9) Shortage of a Few Commodities:

Occasionally, higher utility goods are unavailable in the market, forcing consumers to consume lower utility goods in their place.

10) Supplementary Goods:

Some goods are used simultaneously in a certain ratio and are supplementary to one another like a car and gasoline. Regarding these products, this law is not applicable.